Your typical month-to-month payment would be $440, according to eHealth. com, so you 'd still come out ahead. Naturally, COBRA can still be useful if you require to keep access to service providers who may not be readily available under other plans, or if you know you have a huge medical cost showing up and have actually currently met your deductible for the year.

If you're under 26, the ACA allows you to remain on your parents' medical insurance strategy. Even if you pay your moms and dads the difference between keeping you on their plan and dropping you, this might well be your most affordable option. You can take advantage of this choice even if you're wed or otherwise financially independent of your moms and dads.

If you do not anticipate using your health strategy much, high-deductible plans with lower monthly premiums might be the method to go. Under the ACA, you're eligible for devastating plans with low premiums if you're under 30, or over 30 and get approved for a difficulty exemption. (Challenge exemptions consist of more https://www.linkedin.com/authwall?trk=gf&trkInfo=AQHWVtz8-kGdAQAAAXTLPhLIHS_CKAapx7htIkBD4zHI4Xxn4VC0nRvWDYnTYFFrdWH6ZvxicDCn2d3XWZKSbWYEn4P4wDUBNxIQJ0al5c8KFImVk7sgWwebb-CKyck_RqF44Mk=&originalReferer=&sessionRedirect=https%3A%2F%2Fwww.linkedin.com%2Fin%2Fchuck-mcdowell-39547938 alarming monetary situations including homelessness, recent eviction, and personal bankruptcy see a complete list on health care.

What Does How Much Does Life Insurance Cost Do?

Nevertheless, you'll pay out of pocket for any healthcare outside those parameters until you reach an expensive and jaw-dropping deductible $7,900 in 2019. Insurance providers also have a series of high-deductible strategies readily available straight through their websites. While you'll pay low premiums with a catastrophic or high-deductible strategy, experts state only those who are young and in excellent health should consider them.

If you're going shopping through your state marketplace, know that devastating strategies aren't qualified for subsidies that use to other marketplace strategies. If you're qualified for aids, the savings can comprise the majority of the cost difference in between disastrous strategies and high-deductible bronze plans, in some cases making bronze and even silver more economical because of better coverage.

You can sock away cash in an HSA completely tax-free to assist you spend for healthcare. People can contribute as much as $3,500 in 2019 as long as they are enrolled in a healthcare plan with a deductible of a minimum of $1,350. If you don't use the funds by the end of the year, don't worry they can roll over to the next year.

Rumored Buzz on How To Get Therapy Without Insurance

Short-term or momentary health insurance coverage plans, which normally last for 3 months however can be renewed, are likely your least expensive choice of all. How inexpensive? On eHealthInsurance, they're marketing strategies for as little as $75 a month. I discovered short-term strategies for myself on eHealthInsurance for as low as $77.

However before you get too fired up, keep reading. These plans are also your only choice if you're purchasing health coverage beyond open registration and don't have a qualifying event that makes you eligible for special registration. But before you jump at a short-term strategy to conserve some cash, beware of the risks that come with these bare-bones policies.

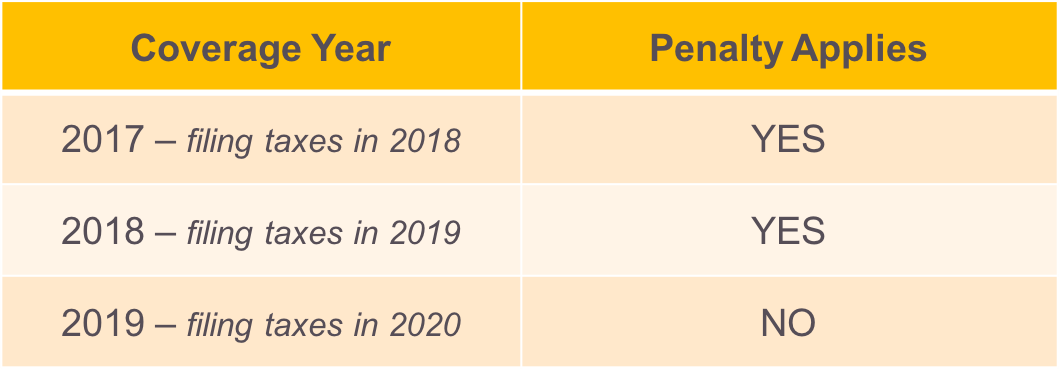

That indicates if you have pre-existing conditions, short-term strategy providers may not cover you, and if you become seriously ill, you may not have the ability to renew your plan. And since short-term plans don't qualify as adequate coverage under the ACA, you will still be struck with the same tax charges that individuals without any sort of health coverage must pay.

All About How Long Can My Child Stay On My Health Insurance

Unlike ACA-approved disastrous plans, preventative care including immunizations and physicals most likely will not be covered. how much term life insurance do i need. The strategies likewise feature a lifetime cap on care, unlike routine health insurance, so you might lack protection in case of very severe injury or disease. They likewise aren't HSA-eligible, and if you do end up needing significant protection, you could still be out a large portion of modification thanks to a high deductible the average yearly deductible in 2018 was $5,953 for strategies sold by eHealthInsurance.

80? It had a $12,500 deductible. Bottom line: There are great deals of constraints to short-term plans, and these strategies have a lot of critics. Although they may be your most affordable choice, it will not really be cheap health insurance coverage in the long run, if you may end up investing a lot more than you planned on, and experts alert against using them other than as a last resort in between jobs.

Whatever your stance on health care reform, there's no rejecting that the ACA has actually given the uninsured a new option. The ACA, the legislation behind the new health insurance exchanges, intends to make cost effective health insurance coverage available to everybody regardless of pre-existing conditions that generally make plans too expensive (or keep them out of reach entirely).

What Is The Minimum Insurance Requirement In California? Can Be Fun For Anyone

You can discover your state's exchange here. As we mentioned, if you're thinking about getting protection under the ACA, act quickly: You need to enroll by Dec. 15 if you wish to get covered starting Jan. 1. If you miss that deadline, you will not be able to enlist for the rest of the year unless you fulfill special criteria such as having an infant, marrying, or losing other qualifying medical insurance.

Plans are classified in 4 tiers: bronze, silver, gold, and platinum. They cover about 60%, 70%, 80%, and 90% of your health-care expenses, respectively (which, obviously, means you would pay 40%, 30%, 20%, and 10% of the costs), with higher premiums connected to the greater percentages. Catastrophic plans that cover less than 60% of costs have the cheapest premiums of all, however they are readily available just if you're under 30 years old or can receive a challenge exemption that waives the cost for going uninsured.

In general, you're more most likely to discover inexpensive medical insurance coverage through the marketplace if you have actually been a high-risk client to insurance companies in the past that is, one who is older or has actually known health issues. how does health insurance deductible work. You might likewise discover more affordable health insurance through the marketplace if your earnings makes you qualified for aids that can help keep your costs down.

The Ultimate Guide To How Much Does A Filling Cost Without Insurance

Check here to seewhether you're qualified for health aids. Just a few more things to keep in mind as you look for budget-friendly health care coverage: You most likely picked up on this when we talked about disastrous medical insurance, however do not just take a look at the month-to-month premium when you're trying to determine what plan you want.

What's the most you'll invest in a year (the yearly out-of-pocket maximum) https://www.springhopeenterprise.com/classifieds/wesley+financial+group+llc+timeshare+cancellation+experts+over+50000000+in+timeshare+debt+and+fees+cancelled+in,212189 if you end up using your health insurance coverage a lot?You requirement to read the small print, which, as soon as you get through it, may not be so fine. Perhaps, for example, there are specific costs that will not go towards your deductible.

And so on. Cheap health insurance coverage might indicate that it's so low-cost, it's virtually useless. There's the Preferred Supplier Organization, a PPO, and a Health Upkeep Organization plan, an HMO. There's likewise a Special Supplier Organization (EPO) and a Point-of-Service Plan (POS) as well as a Catastrophic Strategy, which we have actually covered.

The 9-Second Trick For How Much Is A Doctor Visit Without Insurance

HMOs are cheaper, but there are more restrictions for protection; for example, if you wish to see a professional, you typically will require to get a recommendation from your main care medical professional. A lot of individuals tend to grumble about those referrals considering that it means an additional check out and co-pay to a physician, and if you're in pain, that's extra time you're spending not getting treatment from an expert.