33 per monthon a $100,000 loan, presuming a 1% PMI cost. However, the mean listing cost of U.S. houses, according to Zillow, is practically $250,000 (as of September 2020), which suggests households could be spending more like $3,420 per year on the insurance. That's as much as a little car payment! Up up until 2017, PMI was still tax-deductible, but only if a married taxpayer's adjusted gross earnings was less than$ 110,000 each year.

The 2017 Tax Cuts and Jobs Act (TCJA) ended the reduction for mortgage insurance premiums totally, effective 2018. Most property owners hear the word "insurance" and assume that their spouse or kids will get some sort of financial settlement if they pass away, which is not true. The financing organization is the sole beneficiary of any such policy, and the earnings are paid straight to the lending institution (not indirectly to the heirs first).

Do not be tricked into believing PMI will help anyone but your mortgage lender. Property buyers who put down less than 20% of the list price will need to pay PMI up until the total equity of the house reaches 20%. This might take years, and it totals up to a lot of cash you are literally handing out.

As discussed above, generally when your equity tops 20%, you no longer need to pay PMI. Nevertheless, getting rid of the month-to-month concern isn't as simple as just not sending out in the payment. Lots of lending institutions require you to prepare a letter requesting that the PMI be canceled and insist upon a formal appraisal of the house prior to its cancellation.

One final problem that should have mentioning is http://andersonyxfn165.yousher.com/what-is-short-term-health-insurance-for-beginners that some lending institutions require you to maintain a PMI contract for a designated duration. So, even if you have actually satisfied the 20% threshold, you may still be obligated to keep spending for the home loan insurance coverage. Check out the fine print of your PMI agreement to determine if this is the case for you.

In some circumstances, PMI can be prevented by using a piggyback home loan. It works like this: If you wish to purchase a house for $200,000 but just have adequate money saved for a 10% down payment, you can participate in what is known as an 80/10/10 agreement. You will secure one loan amounting to 80% of the overall worth of the property, or $160,000, and after that a 2nd loan, described as a piggyback, for $20,000 (or 10% of the value).

7 Easy Facts About How To Fight Insurance Company Totaled Car Described

By dividing the loans, you may be able to deduct the interest on both of them and avoid PMI completely. Of course, there is a catch. Really often the regards to a piggyback loan are risky. Many are adjustable-rate loans, include balloon provisions, or are due in 15 or twenty years (as opposed to the more basic 30-year home loan).

Unless you believe you'll be able to obtain 20% equity in the house within a number of years, it most likely makes sense to wait till you can make a larger deposit or consider a less costly house, which will make a 20% down payment more cost effective (how to become an insurance broker).

Private mortgage insurance coverage (PMI) is a kind of insurance coverage that safeguards lending institutions from the risk of defaultor nonpayment by the borrowerand foreclosure. PMI helps homebuyers who are either unable or pick not to make a considerable down payment get mortgage financing at an affordable rate. If a borrower purchases a home and puts down less than 20%, the lender will require the debtor to buy insurance coverage from a PMI business prior to approving the loan.

As las vegas timeshare promotion of 2020, the rate differs between 0. 5% and 1. 5% of the loan. You can pay PMI in month-to-month installations or as a one-time payment, though the rate for a single payment would be higher. PMI benefits the lending institution (the sole recipient of PMI), and it can amount to a large piece of your month-to-month home payments.

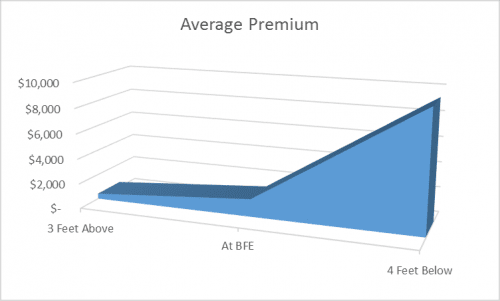

PMI rates can vary from 0. 5% to 1. 5% of the loan amount on an yearly basis. Your PMI rate will depend upon numerous aspects, including the following. PMI will cost less if you have a bigger down payment (and vice versa). If a borrower puts 3% down versus a 10% deposit, it indicates much more months of making PMI payments to the bank.

A credit rating can range from 300 to 850 and is based upon an individual's credit report, that includes the number of late payments and the total quantity of financial obligation exceptional - how much does an insurance agent make. The higher the score, the more creditworthy a customer appears to banks and mortgage loan providers. As an outcome, the greater the credit report, the lower the PMI premium.

More About How To Get Rid Of Mortgage Insurance

Conversely, if you reside in a location where home worths are appreciating, the value of the home could increase enough for you to stop the PMI payments. A new home appraisal would be required, but if the value has 2018 timeshare calendar risen over 20%, for example, you would no longer need to pay PMI.

A conventional mortgage, which is a loan released by a bank, may have a greater PMI than an FHA loan, for instance. An FHA home mortgage is so called due to the fact that it is guaranteed by the Federal Housing Administration (FHA). FHA home loan are issued by FHA-approved lending institutions and are designed to help first-time property buyers and those with low-to-moderate incomes.

The quantity of time you need to reside in a house that makes a single, up-front PMI payment the more cost effective option. Presume you have a 30-year, 2. 9% fixed-rate home loan for $200,000 in New york city. Your month-to-month home mortgage payment (principal plus interest) would be $832. 00. If PMI costs 0.

005 * $200,000) - how does whole life insurance work. As a result, your regular monthly PMI payment would be $83. 33 monthly, or ($ 1,000/ 12), increasing your regular monthly payment to $915. 33. You might also be able to pay your PMI upfront in a single lump sum, removing the need for a month-to-month payment. The payment can be made completely at the closing or funded within the mortgage.

For the very same $200,000 loan, you might pay 1. 4% upfront, or $2,800. However, it's essential to consult your lender for details on your PMI options and the costs prior to deciding.

The average expense of personal mortgage insurance, or PMI, for a standard mortgage ranges from 0. 55% to 2. 25% of the initial loan quantity each year, according to Genworth Home mortgage Insurance, Ginnie Mae and the Urban Institute. Our calculator approximates just how much you'll spend for PMI.NerdWallet's PMI Calculator utilizes your house price, deposit, home mortgage rates of interest, home mortgage insurance coverage rate and loan term, amongst other things.

Indicators on How To Become An Insurance Broker You Should Know

Numerous borrowers do not mind paying PMI if it means they can buy a home quicker. However if the added expense of PMI presses you over your monthly budget plan, you might want to go shopping in a lower rate range or hold off home purchasing till your credit history, down payment amount and debt-to-income ratio, or DTI, improve.